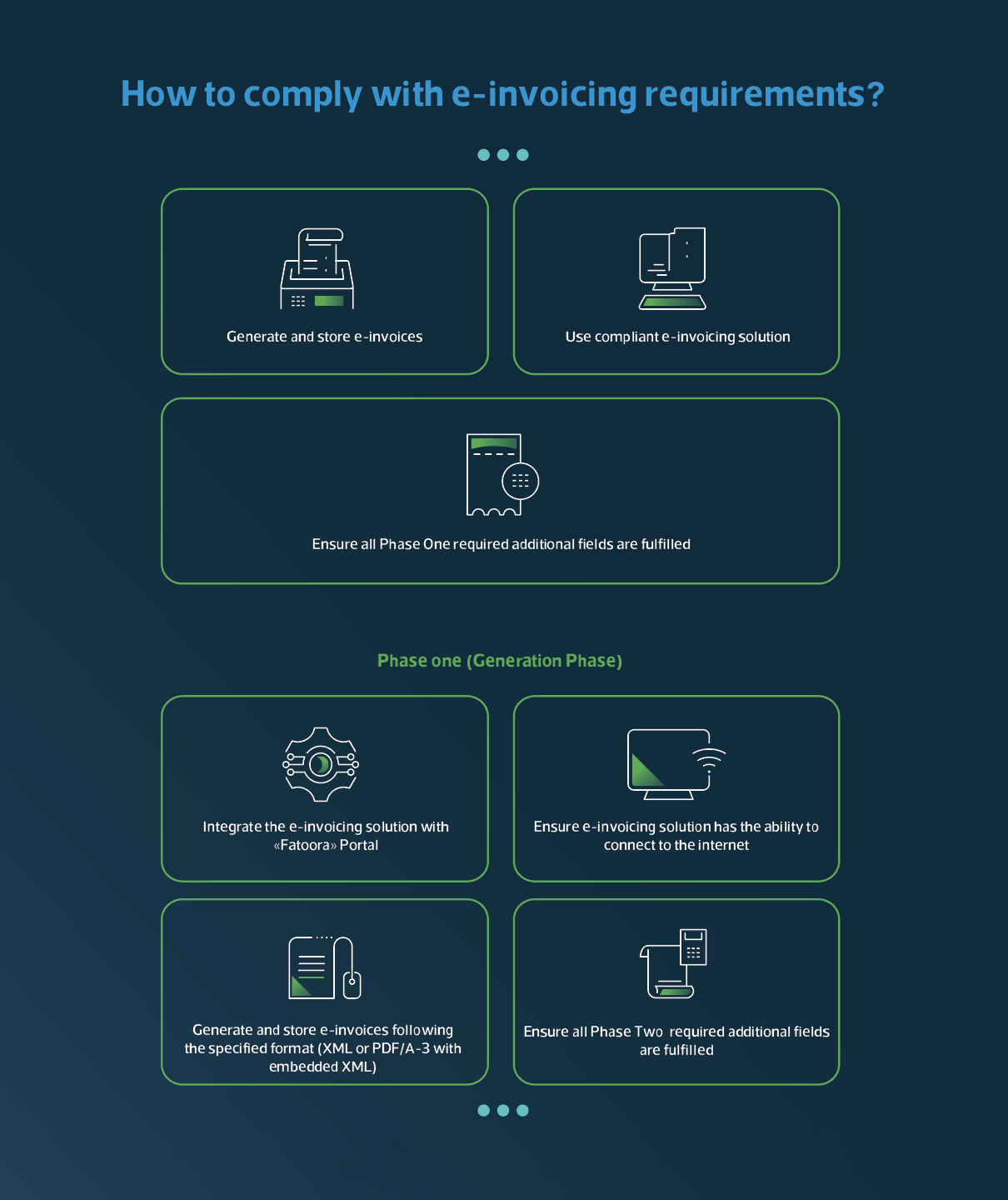

We undertake implementation of Finance/Accounting and POS modules for E Invoicing Requirements which is enforceable starting January 1st, 2023 in waves, wherein the taxpayers should:

- Ability to generate and store e-invoices in the required format (XML) or (PDF/A3 with embedded XML) with the required fields

- Ensure the e-invoicing solution is compliant with the e-invoicing requirements including the ability to connect to the internet

This guide contains the requirements for all taxpayers subject to the E-Invoicing Regulation to prepare and update their invoicing solutions for phase one (generation phase) and phase two (integration phase).

DownloadThis guide contains requirements for E-Invoicing (FATOORAH) as well as technical and security requirements for taxpayers and E-Invoicing providers. It also includes detailed technical requirements such as invoice specifications, data dictionary and security specifications for the E-Invoicing application.

DownloadThis user manual contains the steps of using Fatoora portal to onboard and integrate the e-invoicing solutions.

Downloadthis guideline includes the technical requirements for the e-invoicing solutions.

Download